CroAI – ML Pub Meetup

Invited talk on Superhuman Planning with Large Language Models hosted by CroAI.

I obtained my PhD at ETH Zurich on safe and scalable multi-agent reinforcement learning and was an Associated Researcher at ETH AI Center, supervised by Prof. Francesco Corman and Prof. Andreas Krause.

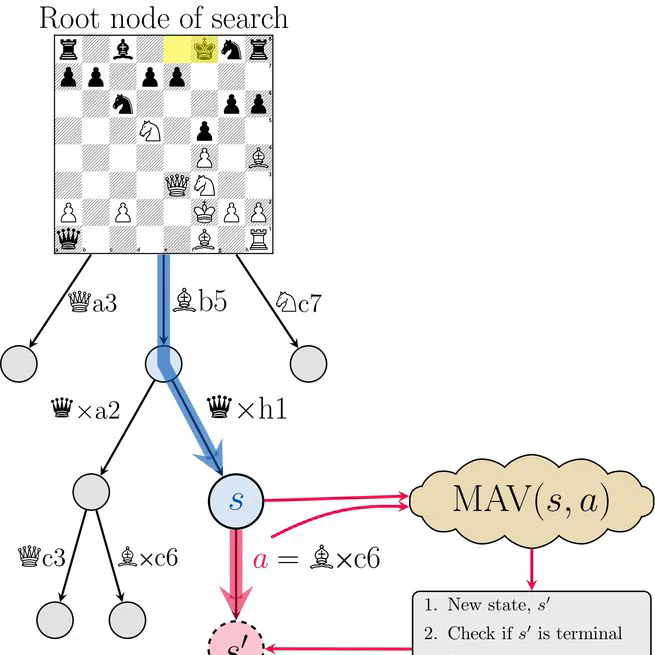

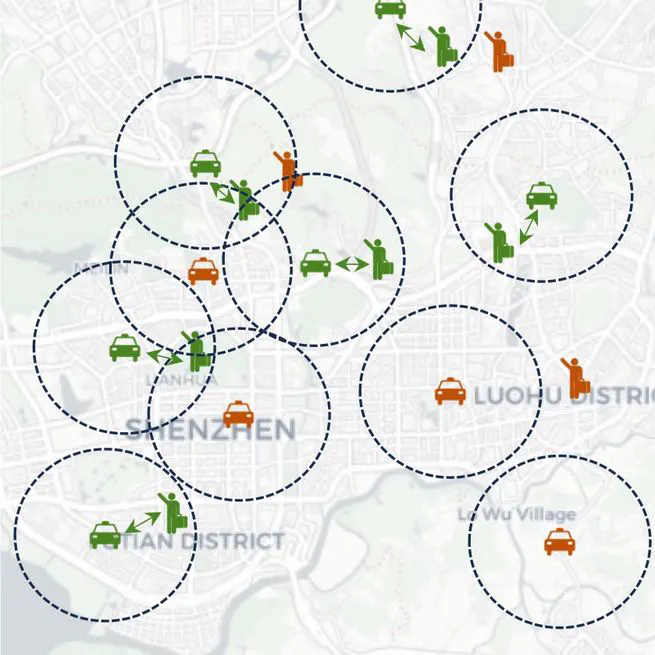

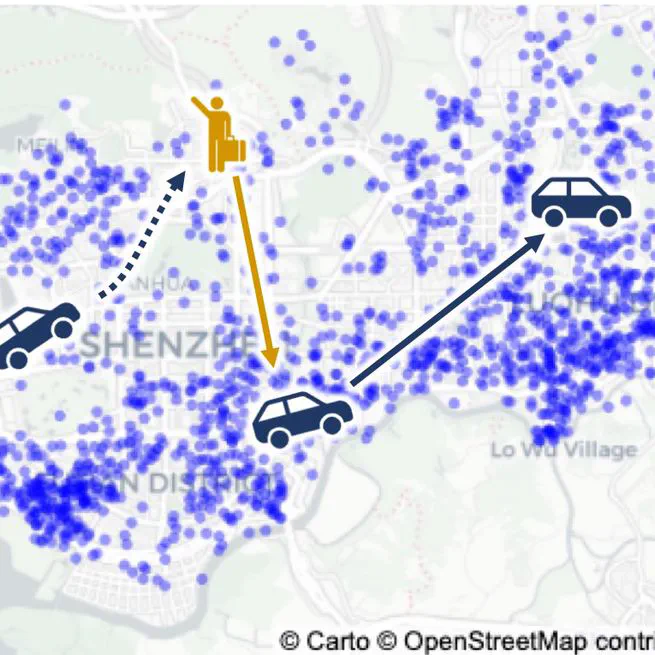

During my PhD, I co-developed a Gemini Chess Gem—the first language model to reach Grandmaster-level performance in Chess with human-comparable planning efficiency. It integrates search-based planning techniques to enhance multi-step reasoning in games like Chess, Chess960, Connect Four, and Hex. This work was part of my Student Research on the Gemini Post-Training Team at Google DeepMind, hosted by Eric Malmi and Aliaksei Severyn.

Before starting a PhD, I worked as a Machine Learning Researcher at Morgan Stanley and as a Senior Maching Learning Researcher, leading a team of four, in a tech startup, Cantab Predictive Intelligence.

PhD in Artificial Intelligence

ETH Zurich

MSc in Mathematical Statistics

University of Zagreb

Visiting Student

University of Bielefeld

BSc in Mathematics

University of Zagreb

ICML 2025 (Spotlight)

May 23, 2025

arXiv preprint

Apr 1, 2025

AAMAS 2024 (Oral)

Dec 26, 2023

Invited talk on Superhuman Planning with Large Language Models hosted by CroAI.

Invited talk on Mastering Board Games With Language Models hosted by ETH AI Center.

Invited talk on Mastering Board Games With Language Models hosted by ZurichAI.

A talk on Mastering Chess With Language Models.

A conference talk on a Safe Model-Based Multi-Agent Mean-Field Reinforcement Learning.

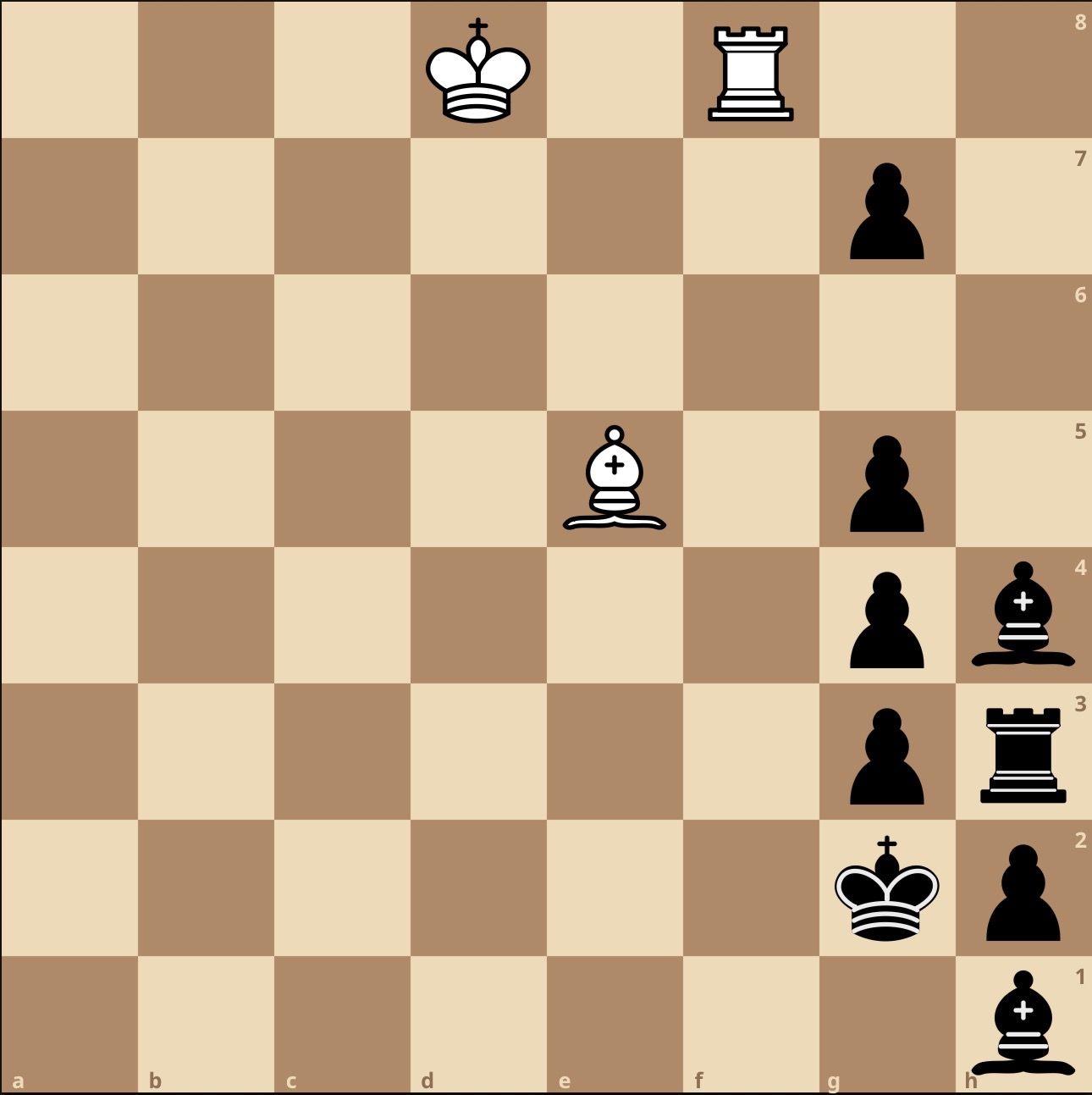

White to move wins.

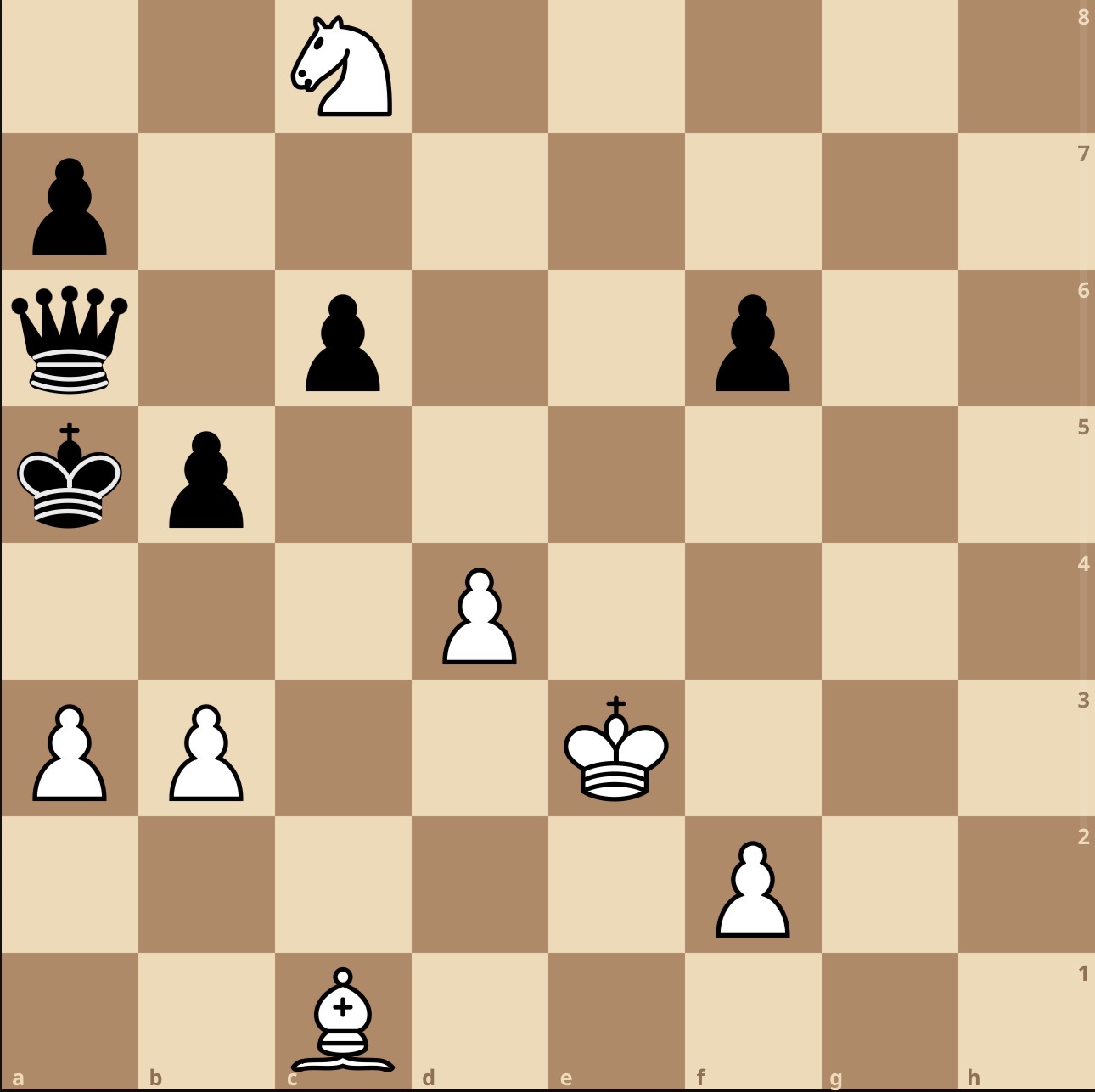

White to move wins.

I am happy to hear your solutions if you can solve it even with the assistance of an engine! I am also open to discussing why many modern engines fail to solve it.

Computer Chess:

I co-developed a Chess Champ Gem for Gemini, which enhances language models with search-based planning techniques to improve multi-step reasoning in board games such as Chess, Chess960, Connect Four, and Hex. It achieves Grandmaster-level performance in Chess with a search move count per decision comparable to human players.

Notable Achievements: